Those in the United States who speak languages other than English can often face barriers to obtaining the assistance and…

What do you have planned for your holiday break? Family time? Catching up on homework? Getting a part-time job? Whatever…

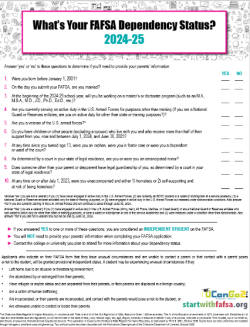

Everyone’s been talking about the sweeping changes that are coming to the 2024-25 Free Application for Federal Student Aid (FAFSA),…

Being a senior comes with a lot of additional responsibilities … testing, college applications, applying for scholarships, preparing for graduation…

The FAFSA (Free Application for Federal Student Aid) is a snapshot of your family’s financial situation on the day you…