February is Financial Aid Awareness Month which is a perfect time to answer questions you may have about the financial…

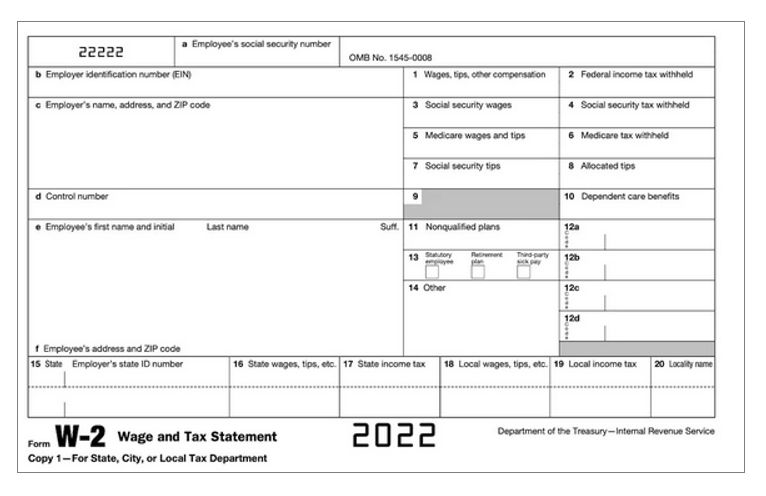

Don’t Throw Your W-2s Away! By February, millions of Americans will have received their W-2s showing the income that was…

First of all, don’t panic or be discouraged. The verification process is usually initiated by Federal Student Aid (FSA), a…

The new year brings fresh beginnings and the opportunity to look ahead. If your future includes education beyond high school,…

What do you have planned for your holiday break? Family time? Catching up on homework? Taking a part-time job? This…