The 2024-25 FAFSA (Free Application for Federal Student Aid) will be available to students sometime this December. We know you’re…

Are you a high school senior who applied for the Oklahoma’s Promise scholarship in the 8th, 9th, 10th or 11th…

November is National Scholarship month making it the perfect time to learn more about scholarships and where to find them.…

Scholarships can be a great way to cover the difference between the amount of financial aid you receive and the…

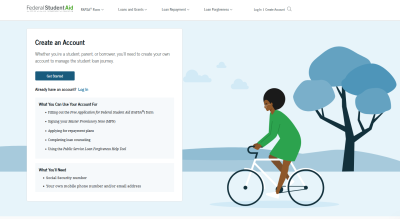

If you’re going to submit a Free Application for Federal Student Aid, or FAFSA, in December, it’s important that you…