Happy mid-summer! You graduated! You finished the FAFSA! You chose a college! You may have even enrolled. But do you…

On May 5, 2023, a new graduation requirement was signed into law that now affects seniors graduating from public high…

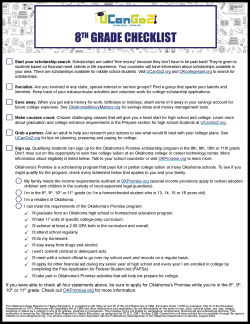

It’s never too early to start preparing for college! At UCanGo2.org, we want every Oklahoma student to have the best…

Want to learn more about the kind of colleges you might like? Take a campus tour! Start by researching schools…

The summer before you start college will be memorable and busy! Relax and spend time with loved ones. But be…