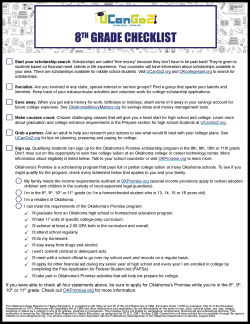

For Oklahoma students planning on attending university, financial aid is important. Oklahoma’s Promise offers qualified Oklahoma students an opportunity to…

It’s never too early to start preparing for college! At UCanGo2.org, we want every Oklahoma student to have the best…

Want to learn more about the kind of colleges you might like? Take a campus tour! Start by researching schools…

The school year is almost over and summer is almost here! If you are an incoming Senior, you probably want…

Each year, the Oklahoma’s Promise Scholarship Program is celebrated at the State Capitol with an Oklahoma’s Promise Day event held…