Happy mid-summer! You graduated! You finished the FAFSA! You chose a college! You may have even enrolled. But do you…

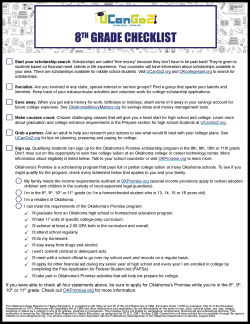

It’s never too early to start preparing for college! At UCanGo2.org, we want every Oklahoma student to have the best…

The school year is almost over and summer is almost here! If you are an incoming Senior, you probably want…

Congratulations! You’ve been accepted to a college or university! Now you need to navigate how to pay for it. Your…

What exactly is a financial aid offer? A financial aid offer (sometimes called an award letter) tells you the amount…