With a new school year comes new Pell Grant amounts and loan interest rates. For your ease, we want to…

For Oklahoma students planning on attending university, financial aid is important. Oklahoma’s Promise offers qualified Oklahoma students an opportunity to…

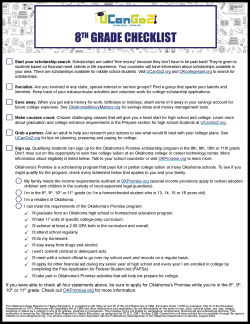

It’s never too early to start preparing for college! At UCanGo2.org, we want every Oklahoma student to have the best…

Congratulations! You’ve been accepted to a college or university! Now you need to navigate how to pay for it. Your…

Each year, the Oklahoma’s Promise Scholarship Program is celebrated at the State Capitol with an Oklahoma’s Promise Day event held…