With a new school year comes new Pell Grant amounts and loan interest rates. For your ease, we want to…

Happy mid-summer! You graduated! You finished the FAFSA! You chose a college! You may have even enrolled. But do you…

For Oklahoma students planning on attending university, financial aid is important. Oklahoma’s Promise offers qualified Oklahoma students an opportunity to…

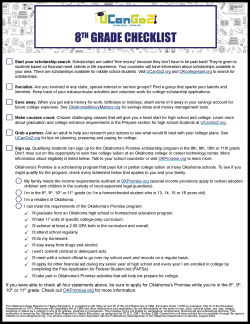

It’s never too early to start preparing for college! At UCanGo2.org, we want every Oklahoma student to have the best…

The school year is almost over and summer is almost here! If you are an incoming Senior, you probably want…