It’s never too early to start preparing for college! At UCanGo2.org, we want every Oklahoma student to have the best…

Want to learn more about the kind of colleges you might like? Take a campus tour! Start by researching schools…

The summer before you start college will be memorable and busy! Relax and spend time with loved ones. But be…

The school year is almost over and summer is almost here! If you are an incoming Senior, you probably want…

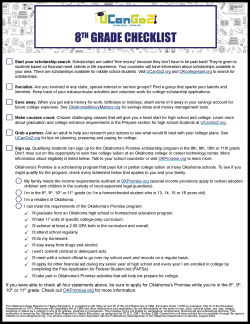

Congratulations! You’ve been accepted to a college or university! Now you need to navigate how to pay for it. Your…