For Oklahoma students planning on attending university, financial aid is important. Oklahoma’s Promise offers qualified Oklahoma students an opportunity to…

High school seniors: Did you know it’s time to submit your Free Application for Federal Student Aid (FAFSA) for the…

The 2025-2026 Free Application for Federal Student Aid (FAFSA) has been released, and seniors across Oklahoma can now start filling…

November is National Scholarship Month, referred to by the National Scholarship Providers Association as a time to raise awareness of scholarship…

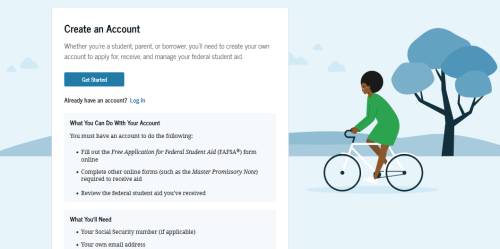

If you’ll be submitting a Free Application for Federal Student Aid (FAFSA) for the first time in December, there’s an…