The U.S. Department of Education recently announced some changes that will make submitting a Free Application for Federal Student Aid…

With a new school year comes new Pell Grant amounts and loan interest rates. For your ease, we want to…

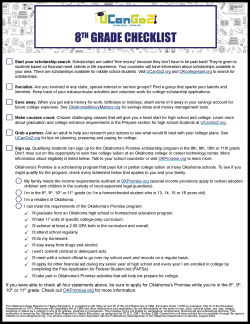

For Oklahoma students planning on attending university, financial aid is important. Oklahoma’s Promise offers qualified Oklahoma students an opportunity to…

It’s never too early to start preparing for college! At UCanGo2.org, we want every Oklahoma student to have the best…

Want to learn more about the kind of colleges you might like? Take a campus tour! Start by researching schools…